Luxury brands should stay privately held

August 28, 2024 Leave a comment

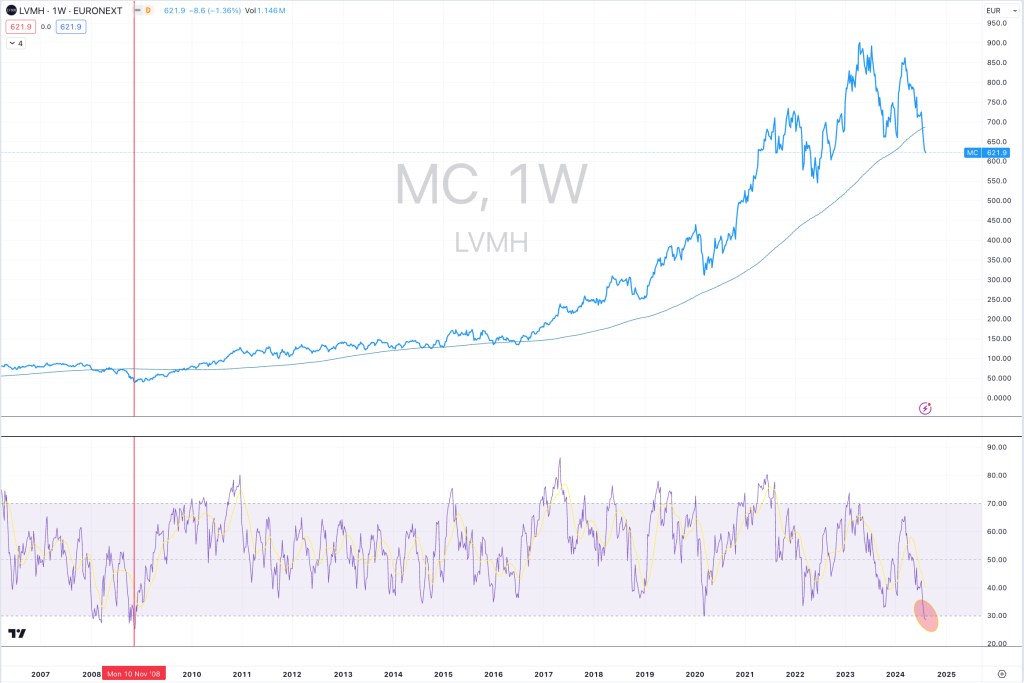

In the #luxury brand business, unless you are consolidator or conglomerate, it’s probably best to stay private.

Giorgio Armani S.p.A. has remained private.

Almost, all others have not.

Years ago, the Salvatore #Ferragamo stock price was a EUR 30, now its trading at EUR 7.50.

Much of this isn’t surprising.

Within 7 years, the company has moved from having EUR 131 in net cash to now holding EUR 485 million of debt, while it continues to carry inventory equivalent to 30% of its sales.

From EUR 1 billion of revenue, it has an EBIT of EUR 57 million and only booking a net profit of EUR 9 million.

(that’s a net margin of below 1%)

With 72.5% of its shares are closely held, all ‘they’ need to find approx. EUR 500 million and buy the 45.5 million free floating shares and go private.

Otherwise……..

August 28, 2024

by Rob Zdravevski

rob@karriasset.com.au