Now that Small Caps have rallied….

December 15, 2023 Leave a comment

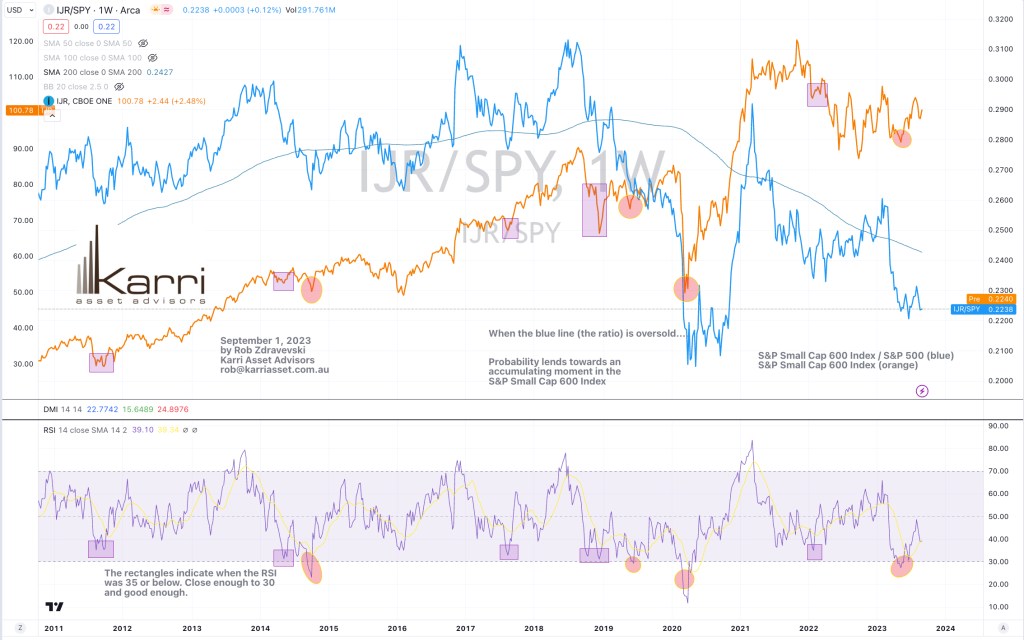

When ‘no one is long small caps’, I published a study (Sept 1, ’23) designed as preparation to buy U.S. Small Caps.

The buying moment presented itself on Friday October 9, 2023.

Since then, the S&P Small Cap Index (and ETF) has risen 17.5%.

If you picked the exact low (seen 2 weeks later) then your return would look like 22%……

but we (at Karri Asset Advisors) are about catching the ‘fat part of the trade’.

2 months on, I am now preparing to sell.

Beyond various empirical analysis that I conduct, other reasons include that I subjectively dislike the price action. It’s not constructive and I think the small cap indices can ‘give up’ nearly all of those gains in the coming month(s).

December 15, 2023

by Rob Zdravevski

rob@karriasset.com.au