Banking stocks are made for trading

February 26, 2024 Leave a comment

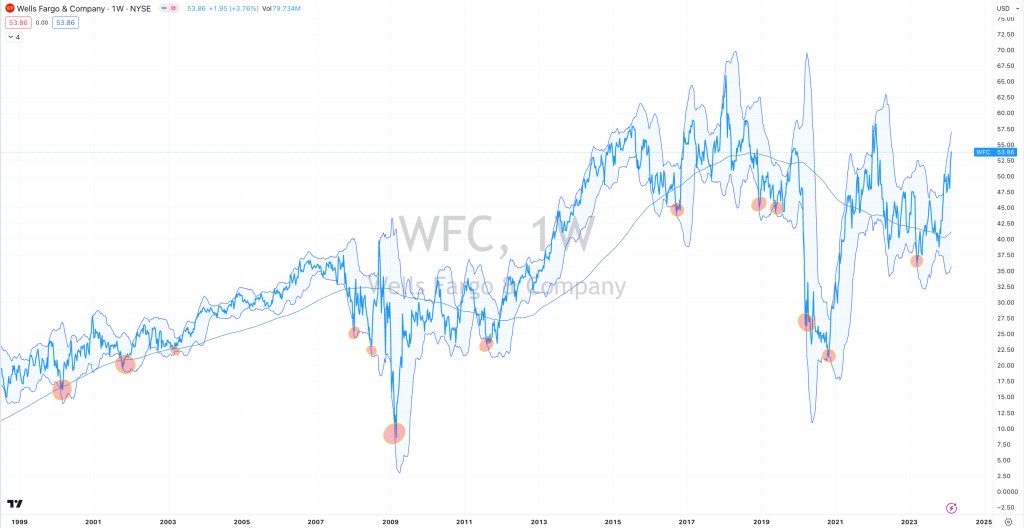

The circles in the chart below suggest moments when to accumulate shares in Wells Fargo & Co. #WFC.US

These are the moments when the stock price has traded below its 200 week moving average and also 2.5 standard deviations below its rolling weekly mean.

This study is only focused on the buying moment and not the selling moments.

Owning #WellsFargo stock hasn’t been synonymous with a ‘set and forget’ strategy. This is the case with many #banking stocks around the world.

Indeed, there are times when you should ponder selling the stock.

For example, today’s Wells Fargo stock price is still the same price it was 10 years ago.

And it hasn’t been an extraordinary compounder over the last 20 years either with an approx. annual return of 4.6%.

At ~ $54, I’m taking the ‘fat part of the trade’.

February 26, 2024

by Rob Zdravevski

rob@karriasset.com.au