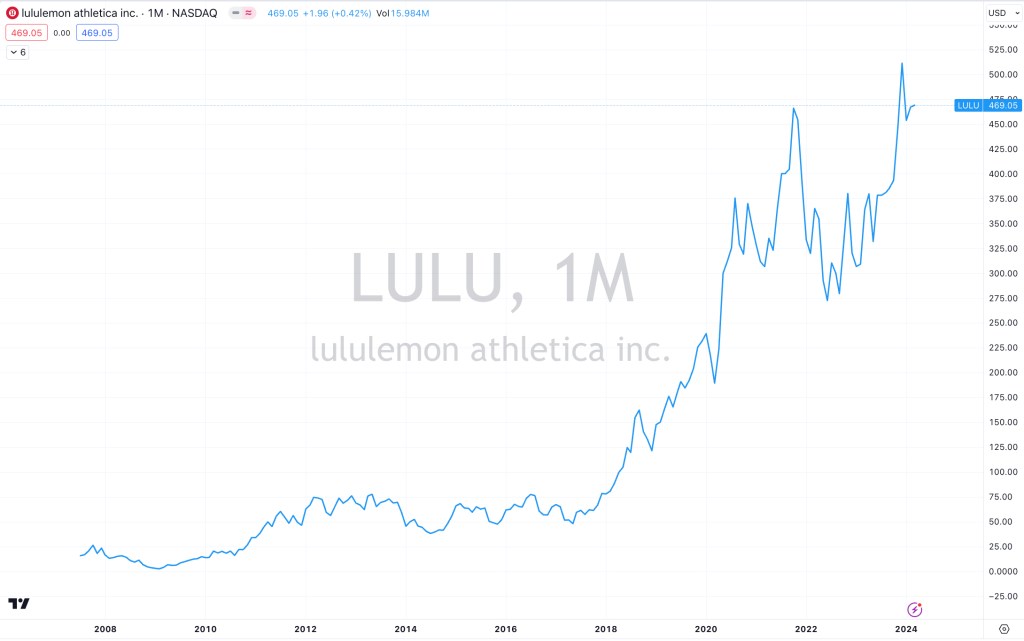

Lululemon’s 11,700% rise in 15 years

March 21, 2024 Leave a comment

Does it matter what #LuluLemon Athletica’s quarterly results are when they are released tomorrow?

In 2008/2009, there was a 5 month period when investors could’ve bought the stock for under $4 per share.

Back then, I felt that I was their most lucrative customer in #LULU‘s Chapel Street, Prahan (Melbourne, Australia) store.

It was my Victor Kiam (of Remington) moment, which I didn’t act on.

Today, the stock is trading at $469, which is 117 times higher.

Is that a 11,700% percent mistake?

And it’s not even a technology company……

And only in October 2023 did the company join the S&P 500 when it’s market cap reached $55 billion.

Perhaps this story falls under the adage of buy your kids (or loved ones) $20,000 of ‘something’ and make them hold it for 15+ years.

March 21, 2024

by Rob Zdravevski

Karri Asset Advisors

rob@karriasset.com.au