Scarcity lies in public not private

February 22, 2024 Leave a comment

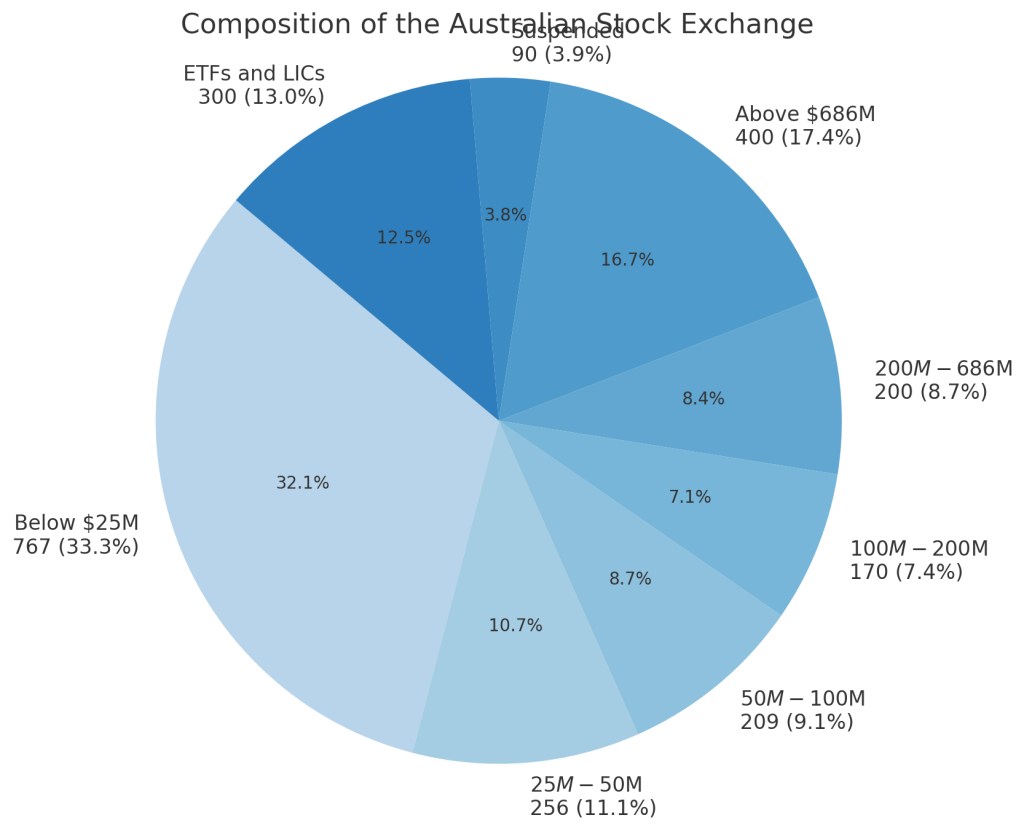

I have attached a graphic to illustrate the number of companies listed on the ASX as they fall within various market capitalisation bands. They are also expressed as a percentage of the total amount of listed entities.

In October 2000 I first wrote a note about the shrinking amount of companies listed on the Australian Stock Exchange in the form of phrase which I refer to as “de-equitisation”.

Then in November 2023, I reprised the topic with this note,

While more Australian publicly listed companies will ‘take too early’, I think that the opportunity continues to lie within the public markets rather than the fantastically touted ‘private equity’ market.

Since the great American de-equitisation commenced, 20 years ago, the S&P 500 has risen at an annual compounded rate of approximately 8.6%. Some reports of private equity funds suggest that they rose around an average annual rate of return of 11.4%.

Whilst there is a notable difference, the S&P 500 metric is a cash return.

I can’t tell if those private equity returns involved much leverage at very low terms of borrowing rates…..but I suspect so.

Today, interest rates aren’t as comparatively low.

Buying scarcity is my motto and Australia (and the world) has exponentially more privately held companies that publicly listed.

February 23, 2024

by Rob Zdravevski

rob@karriasset.com.au