Taking a look at the Canadian 2’s

September 13, 2023 Leave a comment

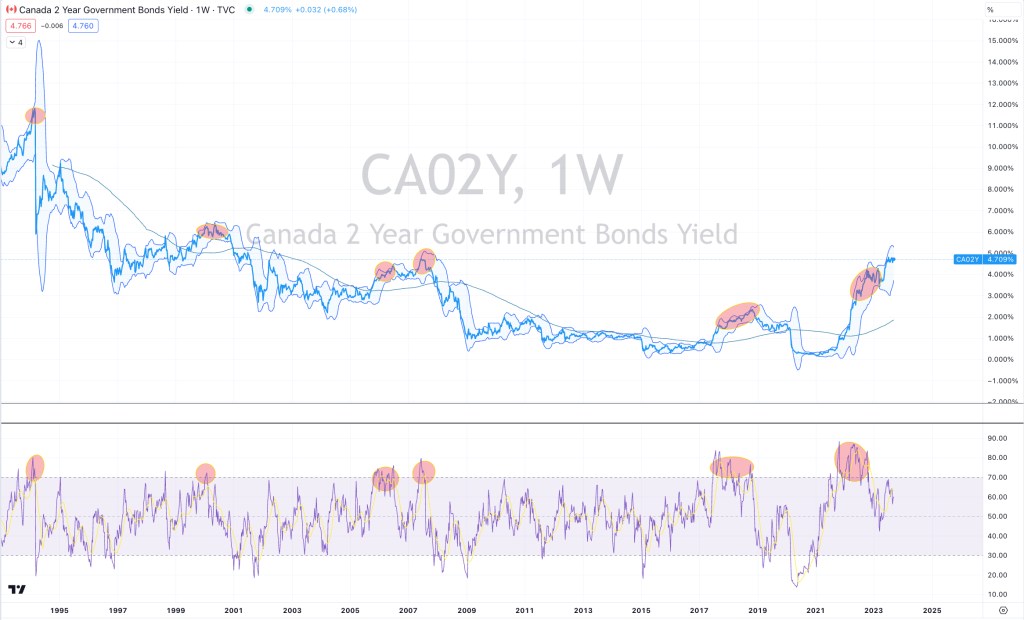

Probability still suggests that mean reversion amongst interest rates beckons or at least a convergence towards it.

The study below show 6 notable periods (over the past 30 years) where the Canadian 2 year government bond yield was trading meaningfully above its 200 week moving average, overbought on a weekly basis and also 2.5 standard deviations above its rolling weekly mean.

This could translate into opposite things for those looking to fix their borrowing rates and those seeking a fixed rate of interest on their cash.

September 13, 2023

by Rob Zdravevski

rob@karriasset.com.au