Chile cuts interest rates with soft hands

July 31, 2023 Leave a comment

To achieve a soft landing, you need ‘soft hands’.

Ask any baseball infielder the importance of having ‘soft hands’.

In an example of managing monetary policy the way it should be done, without political fear or favour…….Chile cuts interest rates by 1%.

They are going to the where the ‘puck’ is going to be, not where it has been.

2 years ago, I started writing how Chile was addressing inflation ahead of other countries.

While referencing their income and GDP per capita, where I cited that “inflation is a tax that the poor can’t afford to pay”, the commodity sensitive (emerging) nations hiked rates much earlier than the G-12 nations.

Chile, Mexico, Brazil have all been ahead of the curve, while the central banks of the countries with the most indebted citizens have needed to tread carefully, in order not to ‘break’ things including the residential housing market.

To give you an example of their pre-emptive action, the chart below shows the Chilean inflation rate.

While inflation has already turned lower, I’ll assume that they expect the lagging reaction to their aggressive hikes to take on a greater effect.

And you can see the Chile government 2 year bond yield also moving lower

This rate cut will also assist Chilean companies with their feasibility and financing of various mining projects.

Also, last month, I found this interview with the Chilean Finance Minister, Mario Marcel very interesting.

Incidentally, he previously served as the Governor of Chile’s Central Bank.

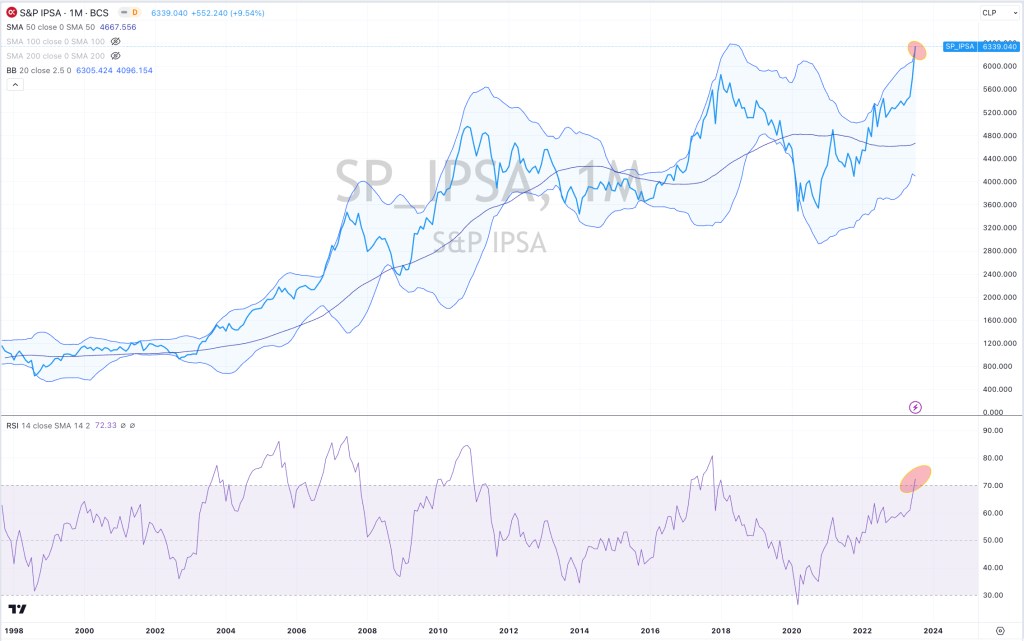

Perhaps perversely, this rate cut occurs while Chile’s stock market is touching some overbought historically overbought levels. It has risen 52% since it’s first rate hike in July 2021 and is now at an all-time high.

This is another example of markets looking much forward than many expect.

The S&P 500 and Nasdaq 100 have risen 2.5% and 11% respectively since the U.S. Federal Reserve Bank’s first rate hike in March 2022.

Since Australia’s Reserve Bank delivered its first rate hike (May 2022), the ASX 200 Index has responded with a rise of 3.7%.

This news in Chile translates into taking profit and re-weighting Chilean equity exposure lower.

My expected retracement in Chile’s IPSA Index should also stifle the latest run in the copper price and give me an opportunity to enter selected commodities on any forthcoming dip.

July 31, 2023

by Rob Zdravevski

rob@karriasset.com.au