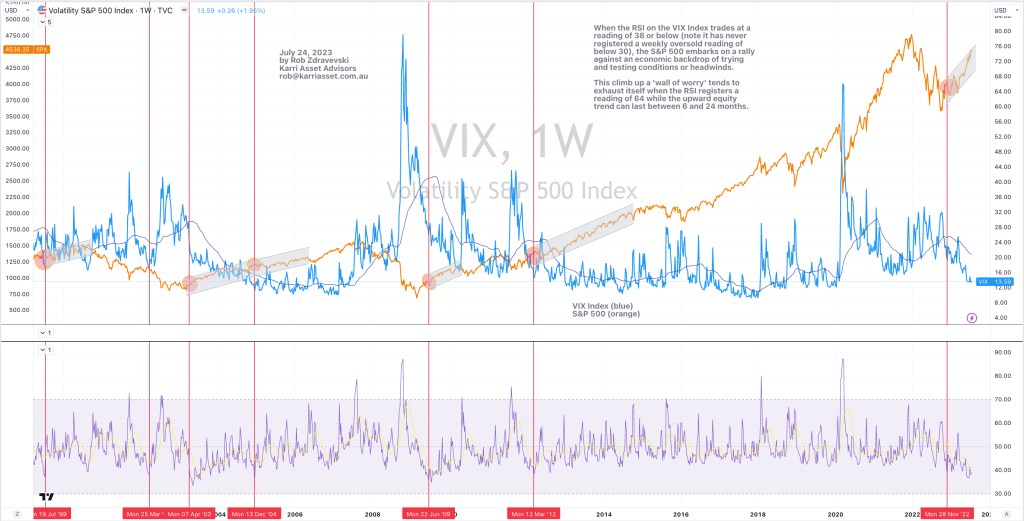

The anatomy of climbing an equity wall of worry

July 24, 2023 Leave a comment

When the RSI on the VIX Index trades at a reading of 38 or below (note it has never registered a weekly oversold reading of below 30), the S&P 500 embarks on a rally against an economic backdrop of trying and testing conditions or headwinds.

This climb up a ‘wall of worry’ tends to exhaust itself when the RSI registers a

reading of 64 while the upward equity trend can last between 6 and 24 months.

An RSI above 64 and ultimately a reading above 70, is then when we see ‘absolute’ worry.

For now, I’ll be wary of my equity allocation and exposure as any further index advance isn’t evolving from a base of bargain hunting.

July 24, 2023

by Rob Zdravevski

rob@karriasset.com.au