Crude Oil is your inflation proxy

June 30, 2022 Leave a comment

Gold hasn’t been a good inflation hedge

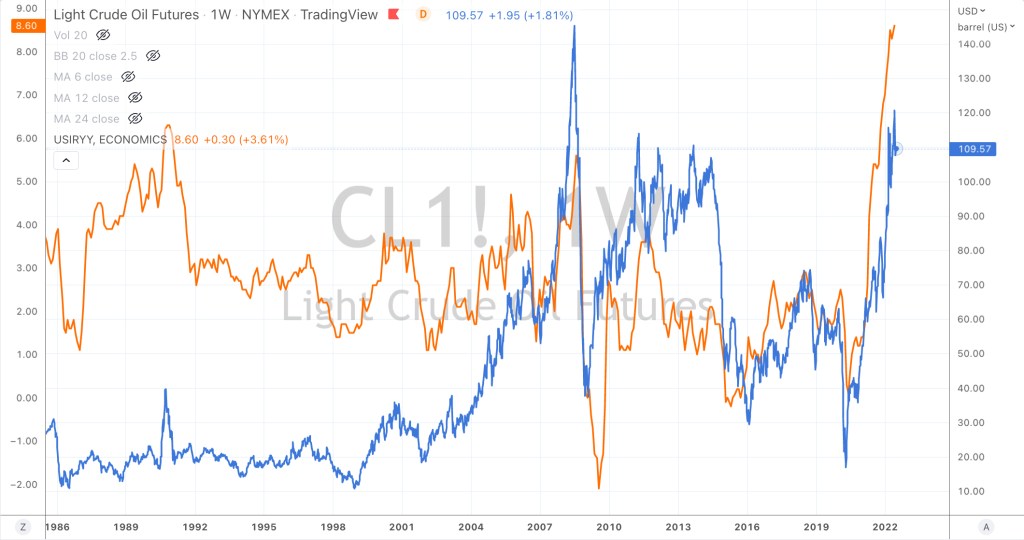

Whether you want to call it a hedge or a proxy, the chart below shows the WTI Crude Oil price (in blue) laid over the U.S. Inflation Rate (the orange line).

If you don’t want to get involved in an interest rate trade and you are thinking that inflation will rise, buying long-dated Oil call options have worked a treat.

Be careful, this theory works when inflation is (or about to) rise.

It doesn’t work if inflation stabilises or remains constant.

Today, you’ll need to be aware of where the pendulum is, for both of them.

June 30, 2022

by Rob Zdravevski

rob@karriasset.com.au