I prefer an Oversold yield curve

March 14, 2022 Leave a comment

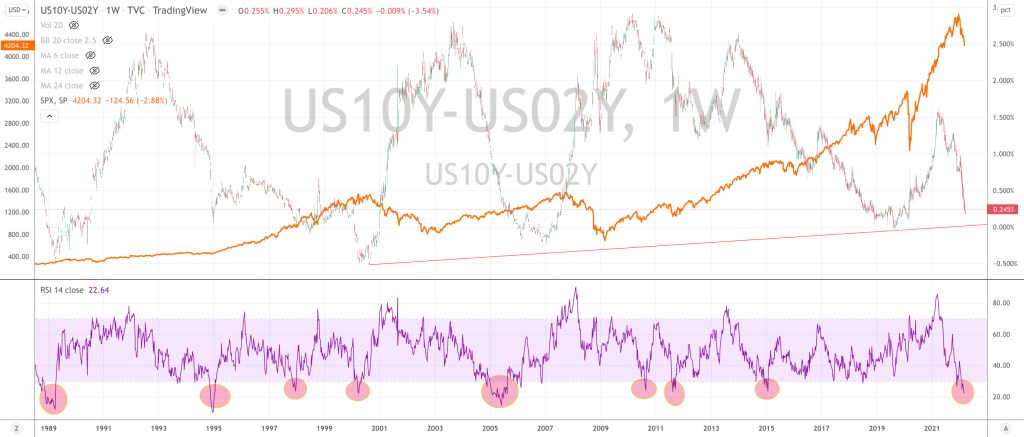

Here is the US10-US02 bond yield spread (the yield curve) overlaid against the S&P 500.

If you closely track when the yield curve goes ‘notably’ Oversold (on a weekly basis), it’s prescient that the S&P 500 finds support for its next advance.

Now it is doing this for the 9th time in 35 years.

The only time when a new S&P 500 bullish trend was stifled or diffused, was when the yield curve moves sharply to an Overbought level (or more specifically to a reading near to 62 or above) within 10 months of seeing its previous Oversold moment.

Coinciding with my earlier posts today, the timing of entry will be the artistic part.

The science of seeing the yield curve touching 0.08% – 0.02% may aid the decision.

March 13, 2022

by Rob Zdravevski

rob@karriasset.com.au