One year on, it’s less fertile

May 9, 2021 Leave a comment

In March 2020, the S&P 500’s forward P/E estimate momentarily dived (the red line in the chart below) to 14.

It was difficult to guess what future earnings would be, so I added an arbitrary 25% to the estimate, placing my forward P/E ratio estimate at 17.5.

This means the index had an earnings yield of 5.7%.

At that time, the 10 year government bond was yielding 0.8% which meant the earnings yield was 7 times more than the ‘risk-free’ rate.

That was its highest multiple since World War 2.

It led me to determine that equities were indeed a fertile habitat, as I wrote in a July 2020 newsletter.

https://mailchi.mp/karriasset/equities-the-fertile-habitat

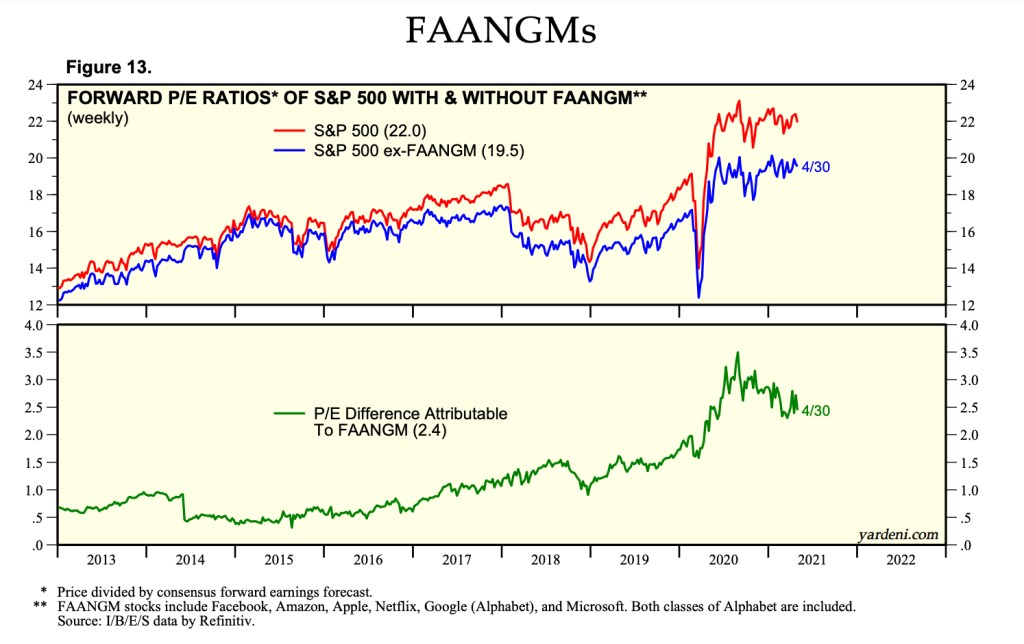

Today, the S&P 500’s forward P/E is 22.

So comparing its earning yield of 4.5% to a 10 year bond yield of 1.59% placed this ‘spread’ on a comparatively measly 2.9 times.

If we remove the dominance of the FAANGM stocks (these 6 stocks account for 24% of the S&P 500’s market capitalisation), then the SPX forward estimate P/E drops to 19.5.

The earnings yield becomes 5.1%. The difference over the risk free rate remains an uninspiring 3.2 times.

This means it’s a less interesting environment for beta orientated index hugging investors and more alluring for the stock-picker.

May 9, 2021

by Rob Zdravevski

rob@karriasset.com.au