Following the paper trail

November 2, 2020 Leave a comment

The links below follow my time series of posts about a Lumber trade which commenced in July 2020….

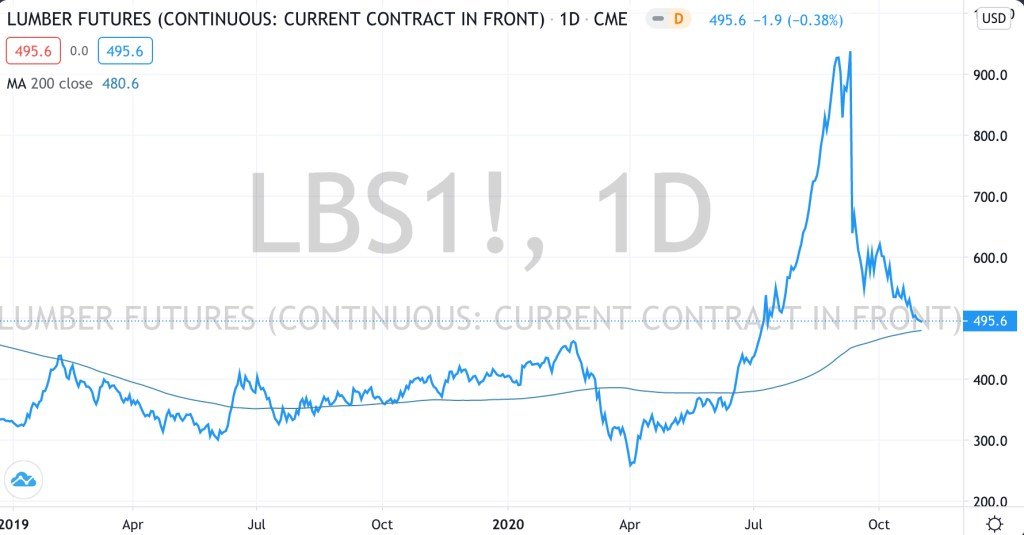

Today’s chart below shows Lumber halving from its recent high, to come back and say ‘hello’ to its 200 day moving average.

Some points which come to mind are:

a) catching the fat part of the trade is good enough,

b) it’s OK for prices to go higher without you being on board,

c) many times it’s knowing when not to be in a trade (when the reward doesn’t outweigh the risk being taken),

d) mean reversion eventually happens.

Previous Lumber blog posts, in chronological order;

November 2, 2020

by Rob Zdravevski

rob @karriasset.com.au